Gordon Family Law believes that an informed client can make better choices, both financially and emotionally. You can see a complete list of every answered question at our Article Hub. If you have a question not answered, please email amanda@gordonfamilylaw.com. This Blog is not intended to be used as legal advice, please note that case law and statutes change over time and information on this website may not be current. While we hope you find this information helpful, it may not necessarily apply to your situation and we recommend that you speak to a family lawyer about your specific case.

What are Financial Disclosures in Divorce?

/What is a Declaration of Disclosure?

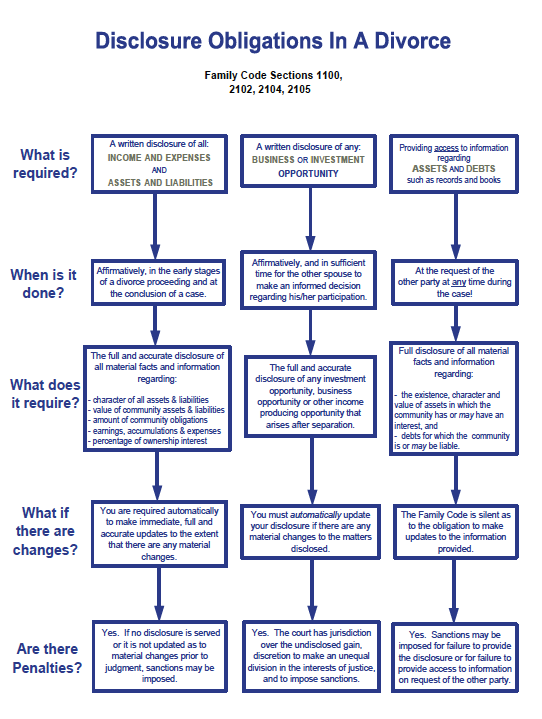

California divorce law is designed to protect the transparent exchange of financial information in a divorce. Thus, both parties must exchange full financial disclosures before a divorce can be finalized.

Will my tax returns, pay stubs, and bank accounts be public record?

Generally, no. California law requires that each party serve his or her declarations on the other party but that these declarations are not filed with the Court. Family Code Section 2104. While the declarations do not need to be filed, the Court does require a proof of service that the declarations have been exchanged.

When do I need to give the other side my financial documents?

California law requires that parties exchange financial documents within 60 days of a Petition or Response. However, this requirement can be waived by mutual agreement of the Parties.

Do I have to make full statutorily required financial disclosures in mediation?

/Not necessarily, although it is best practice. Under Marriage of Woolsey, parties who agree to settle disputes by private mediation may also agree to make financial disclosures that do not meet the technical procedural disclosure requirements of Fam C §§2104 and 2105.

The Court found that "the parties to a dissolution are entitled to adopt other, more summary procedures for financial disclosure." The Court found that requiring technical compliance with disclosure rules would undermine the strong public policy of allowing parties to choose speedy and less costly avenues for resolving their disputes. This means that strict compliance with Fam C §§2104 and 2105 is not required for private mediations.

Is it contempt to fail to fill out your income and expense declaration?

/The best family law attorneys in San Francisco Bay Area will inform clients about the importance of financial disclosures.

An Income and Expense is declaration is a budget worksheet used for several reasons: establishing/enforcing child support, spousal support, attorney fees, sanctions.

California courts require the exchange and submission of financial disclosure documents (I&E, preliminary and final declaration of disclosures) in all dissolution, legal separation and nullity actions.

Can I be held in contempt for failing to file an Income and Expense declaration? No California court has ever held an individual in contempt for filing a false I&E or FL 142. However, the court has inherent jurisdiction and a party may request sanctions under the Family Code for monetary sanctions in an amount “sufficient to deter repetition of the conduct or comparable conduct.”